A piping hot bowl of instant noodles is ‘comfort food’ for lakhs of Indians, because it’s filling, affordable and the spice levels can be adjusted ‘swaad anusaar’.

One such brand is called Wai Wai, the blockbuster noodle brand from Chaudhary Group, Nepal that has been quietly making inroads into India for the past 40 years, helping consumers evolve their palate towards newer noodle flavours and spices. For Binod Chaudhary, chairman, CG Corp Global, his aim is to now establish a deeper presence in India and achieve the same kind of brand loyalty that the brand enjoys in Nepal.

Lets know how CG Foods has aggressively been planting its flag across all regions in India- with the help of a spiffy end-to-end supply chain solution that offers them all the data transparency they need to reach the right customers with the right products.

Chaudhary Group | Foods

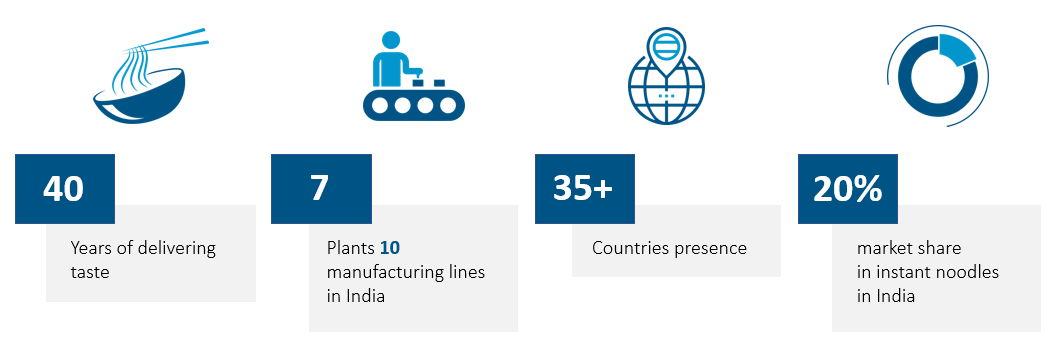

Established in 1984 in Kathmandu, CG Foods is an ISO 9001:2008 certified company. Today it has the capacity of manufacturing 2100 packets of noodles per minute or 40,000 tonnes per year. It has also increased its product portfolio to Extruded Snacks, Potato Chips, Fried Snacks, Fruit Drinks, Chocolate Enrobed Wafer and Broken Noodles popularly known as Bhujiya.

India currently consumes 25% more Wai Wai than Nepal, but there is still a huge, untapped potential in the under-penetrated noodles market in India, which is what the brand wants to tap.

What’s unique about Wai Wai noodles is their versatility – since they are fully cooked, pre-packaged noodles, they can be eaten straight from the pack as a snack, or boiled to make a slurpy noodle soup. CG Foods has also launched region-specific flavours like a Fish flavour variant for West Bengal, a Jain noodle variant for Northern customers, which does not include garlic and onion, and Akbare Chicken Noodles for East and North East India. This has helped the brand create a unique niche for itself. But the biggest challenge is to increase overall consumption.

Nepal, a country of around 30 million people, has an annual per capita noodle consumption of 55 packs. For India, which is a country of 1.3 billion-plus people, it is a meagre 5 packs. But Mr GP Sah, Global Business Head – FMCG, Chaudhary Group, is confident that the consumer spending on the Wai Wai brand will cross Rs 1,000 crore in FY 20-21

GP Sah knew that there was absolutely no way his team could reach an ambitious goal of Rs. 1000 crores if he didn’t have the right strategy and the right platforms, so he identified 3 big priorities in his wish list:

In Nepal, WAI WAI noodles is the undisputed leader in instant noodles but in India, they still weren’t a big name. For a company that was a market leader in one country but a growing brand in a complex country like India, the task was all the more challenging. That was because, in Nepal, they didn’t have to focus on secondary sales because the distributor inventory would liquidate easily because of high demand. However, in India, they had to push through the competition and change their own mindset to focus on secondary sales as well.

GP Sah was keen to grow Wai Wai in regions other than North East India (which accounts for more than 60% of the market share in India itself) to have a stronger national footprint.

Putting their strategy into motion, CG Foods hired a large salesforce across India. However, his sales leaders struggled with getting the actual information on what each salesperson was doing on the ground, how much market they were actually penetrating, was there more market potential in areas they were present in etc.

To do that, GP Sah required a strong technology partner who could offer precise analytics, help in timely execution, and provide real-time monitoring to establish an aggressive footprint in India.

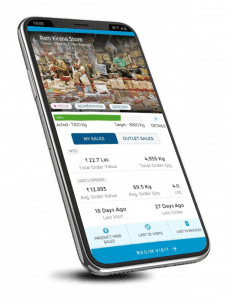

Mr Varun Chaudhary and GP Sah were both so committed to adopting an automation solution that they flagged off a special project called ‘Unchi Udaan’ to launch the FieldAssist app for their sales team. As the MD himself gave 100% support to this project, the adaptability by the users was never a challenge.

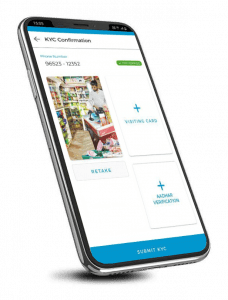

The first thing our team did was to revamp the market planning for their 2 lakh outlet universe. This helped them understand which markets to go in and at what frequency, how many beats are required for territory, how many salespeople are required to service those outlets etc.

Further, we sanitized almost 15000 beats out of the system, which was not mapped to any salespeople. Then the salespeople were re-assigned to authenticated beats, which immediately improved efficiency and productivity. Now they have visibility of the entire salesforce at an individual level as well as granular-level secondary sales down to outlet-level.

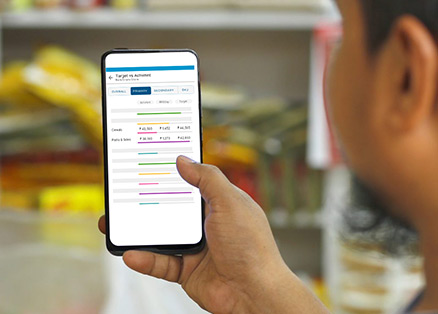

Today GP Sah’s sales leaders use Quick Viz extensively to get shop-type data on Region wise TC/PC, Average Net Value, Average PC Performance, outlet category-wise sales, state-wise, territory-wise net value etc.

With Beat-o-meter, the sales leaders can assess the number of dormant and to-be dormant outlets, and devise category-type initiatives to rekindle those outlets. They also have a view on their high-performing outlets and are able to strengthen those retailer relationships even more.

For all sales leaders at CG Foods, FieldAssist is the only source of sales data. Senior-level reviews have become a breeze as real-time, updated data is always available. The biggest difference is how clearly they are able to see real-time coverage of the market every day.

From established industry leaders to young startups, 600+ brands believe in us.

© Copyright 2024 Flick2Know Technologies Pvt. Ltd.