Menu

Close

Did you know that India is the 2nd largest footwear manufacturer in the world with 9% of the annual global production of 22 billion pairs? Today, India’s consumption stands at 2.1 billion pairs and is the third largest globally after China and USA. While there are many MNC brands and Indian brands that command a decent share in the otherwise unorganized industry, there is one brand that stands out, Campus Activewear! This made-in-India brand dominates the affordable, mass-market footwear space in north India and some parts of south and west. Looking at the untapped potential of the industry, Campus Activewear wanted to further expand its presence across all the major cities in the country.

But was it possible to do that with their current people and current resources? Most likely not! They needed a technology that could become the ‘jet fuel’ to catapult their rocket to the next orbit of growth. FieldAssist was proud to be chosen as the ‘jet fuel’, and thus started an extremely rewarding and fulfilling journey of working with the fastest-growing footwear brand in India.

Here is a summary :

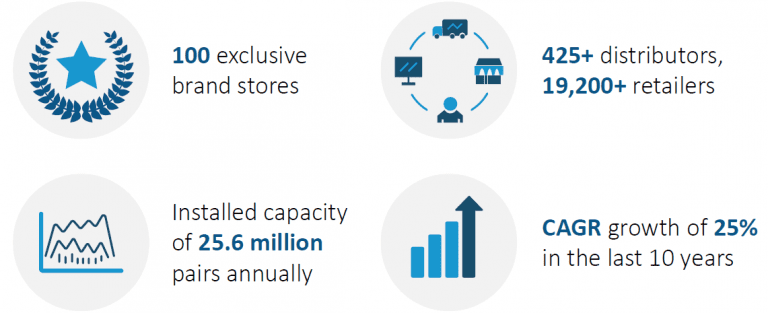

Introduced in 2005 as a lifestyle-oriented sports and athleisure brand, the ‘Campus’ brand offers a diverse product portfolio for the entire family. Today they are the fastest growing sports and athleisure footwear brand ( brands with over ₹ 2 billion of revenue in 2019 ), where the men’s category contributes over +80% of their overall sales. Around 75% of its sales come from non-metro cities and Tier-I regions contribute the rest.

The footwear industry in India has some very unique points. One, it is extremely unorganised. There are many locally produced footwear brands that compete on price points. Two, the industry is mostly distributor-driven, which means they identify the styles and designs they want to order from the company catalogue. This also means that retailers don’t have much say on the designs or styles they want to keep; they just choose from the options that the distributors have. Therefore Sales Officers also tend to skip visiting retail outlets and only punch in primary sales at distributor points. For the brand, the visibility of product movement stops at the Distributors.

The leadership team at Campus Activewear wanted to do away with this lack of transparency and visibility. In such a highly unorganised environment, Campus Activewear wanted to disrupt the way they approach sales & distribution so they could accelerate their pace of growth. Their biggest challenges were:

To achieve all these goals, the leadership team at Campus Activewear knew that they would need a very strong technology partner who understood the peculiarities of their industry, could solve their most recurring problem statements and could also map out the future roadmap efficiently.

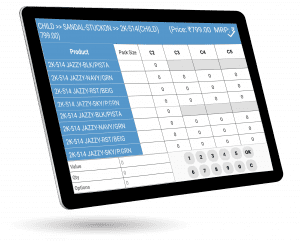

Campus Activewear lays a lot of emphasis on product innovation and creating contemporary designs that cater to Gen Z and the Millennials. They wanted to bring the same approach and rigour in creating one of the most efficient sales and distribution structures in the industry. By deploying the FieldAssist GT app, Campus Activewear was able to introduce an FMCG-style retailing work culture, which was absolutely unheard of in the footwear space!

Keeping the company’s goals and challenges in mind, the FieldAssist team started by first streamlining the basics. As shoes are not fast-moving items, they would lie at retailer points for months. The FieldAssist team created optimised route plans for all territories to calibrate the right frequency of visits for different outlet categories. This helped them get better traction on secondary sales.

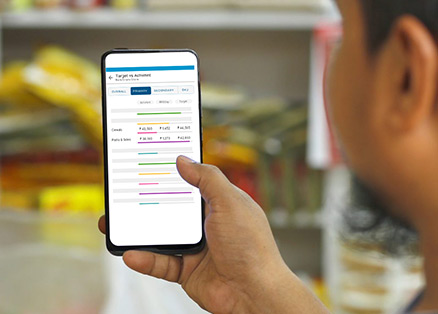

For Surender Bansal, the Country Head (Multi Brand Outlets), the biggest tangible change was the increase in the ROI on ‘people cost’. Real-time analytics from the FieldAssist platform gave him immediate visibility on individual numbers. He was able to nudge his mid-managers to make regular field visits, oversee key outlets directly, and do Joint Working calls with team members to identify any red flags or upskilling requirements.

Surender’s team improved product penetration on a greater number of outlets, and also increased the depth of distribution, especially for the ‘Wonder Articles’ or the focus products. The process of ‘technovating’ the entire sales process was now complete.

Campus Activewear partnered with FieldAssist almost three and a half years ago and the results are nothing short of spectacular.

Campus Activewear had nearly 15% market share in the branded sports and athleisure footwear industry in India by value in 2020, which increased to 17% in 2021. As on date, their revenue from trade distribution stands at 63% versus the revenue from online/ D2C channels at 32%.

Today, they are keen to extend their distribution network and deepen their presence in the western and southern areas.

As the Campus team crackles with excitement about its impending IPO, we will be waving and rooting for Campus Activewear from the sidelines when we see their name light up on the stock exchange! Go Campus!

From established industry leaders to young startups, 600+ brands believe in us.

© Copyright 2024 Flick2Know Technologies Pvt. Ltd.