Challenges in CPG Industry

Considering how dynamic the consumer goods industry is today, there are many Challenges in CPG Industry, as CPG brands need to develop comprehensive strategies that are rooted in the needs of the future consumer. For a CPG leader like you, it means insulating yourself against known external volatilities as well as preparing for the unknown ones. Such preparedness can only be achieved when brands stay agile and completely attuned to possible challenges that come up tomorrow. To help you better understand how you can stay nimble and face the future Challenges in CPG Industry confidently, we’ve spoken to industry experts and CPG founders to curate the 6 big Challenges in CPG Industry that can expect to come their way.

1. Cyberattacks can make your supply chain more vulnerable

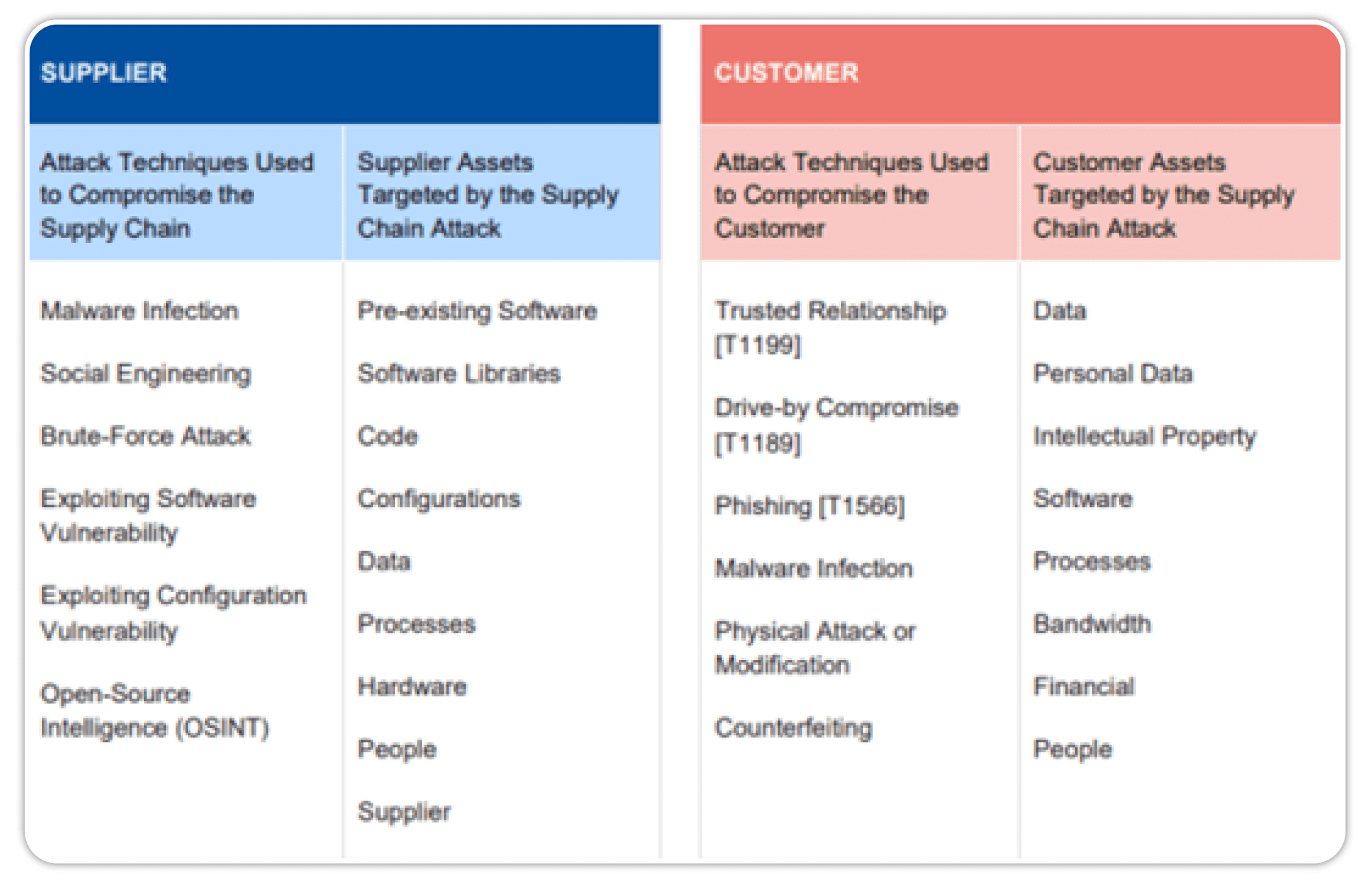

A lot of companies digitize their supply chains due to Challenges in CPG Industry. But digitization also makes them vulnerable to the possibility of cyber-attacks, which can compromise sensitive information and disrupt their operations. CPG leaders need to redefine strategies and identify the cyber loopholes with their supply chain partners. For new suppliers in the standard onboarding process, it may be worth exploring the funding and implementation of artificial intelligence (AI) or machine learning (ML) technology to detect potential threats like spam and phishing emails.

One will need to mitigate the risk of cyber-attacks by addressing the human element, as it accounts for almost 95% of successful breaches, according to a recent report by the World Economic Forum. According to the threat landscape report published in July 2021 by ENISA, some Challenges in CPG Industry is that very damaging attack techniques are used to compromise the data of customers as well as suppliers in the supply chain.

This evaluation will need to focus particularly on those functions that have direct access to sensitive information, including areas that serve as an entry point for broader system access, e.g., pre-existing software used by the supplier, their web servers, cloud applications, firmware, databases, applications, their monitoring systems, software packages installed by third parties like ruby, NPM etc., source code produced by the supplier, hardware like USBs, or the targeted individual(s) who has access to important data. Other prominent vulnerable areas also include things like passwords, URLs, firewall rules, and API keys.

2. Scope 3 emissions will be a key metric to assess your carbon footprint

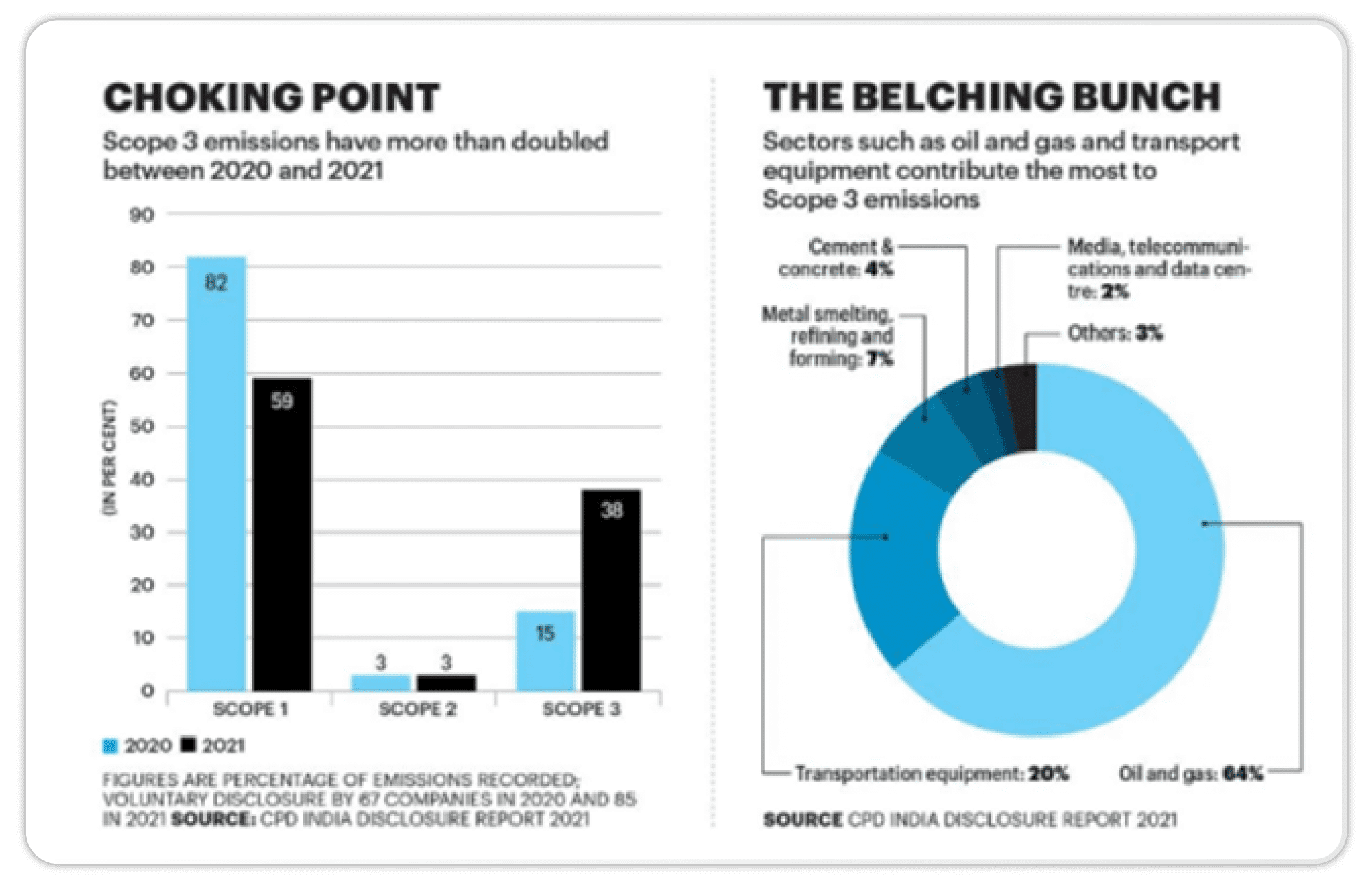

To measure greenhouse gas emissions, the CPG industry follows some protocols to face Challenges in CPG Industry, many of them tethered to Scope 1 and Scope 2 emissions. There is one more type of emission which accounts for 75% of the total industrial carbon footprint- Scope 3 emissions (this is the indirect emission attributed to vendors and suppliers, as their activities are executed outside the organization).

The report by CPD India Disclosure for the year 2021, the graph below shows that the Scope 3 emissions have increased from 2020 to 2021, almost more than double.

Anvesha Thakker, Partner & Lead for Renewable energy at KPMG in India, says, “There are challenges around collecting accurate data on Scope 3 emissions due to the large supplier base of organizations dispersed across different geographies. This makes it difficult to set an accurate baseline and measure progress,”. Therefore, FMCG leaders must operationalize their ESG strategy by aligning the objectives of various functions like Operations, IT, HR, Finance, and commercials to help reduce the scope 3 emissions from India.

Many MNCs like Hindustan Unilever Limited (HUL), have already commenced work on curbing Scope 3 emissions Challenges in CPG Industry by zooming in on the contributors to these emissions, for instance, logistics. HUL has identified a subset of their suppliers whose materials have been putting the highest impact on climate. They have also formed ‘Unilever Climate Programme’, where its top suppliers will measure, report and reduce their emissions. The HUL spokesperson says, “We are exploring cutting-edge technology to reduce material carbon footprint at the suppliers’ end, such as carbon capture technology,”.

We’ve also seen a shift in the behavior of investors towards companies who are able to stay low on their Scope 3 emissions as compared to their counterparts. This trend suggests that banking institutions, private equity firms, and venture capitalists want to ensure that their investment portfolios are aligned with sustainable companies. These developments have given an impetus to FMCG leaders to rethink their Scope 3 emission strategies, and align them with their future plans to face Challenges in CPG Industry.

3. The cost of living crisis is shrinking the middle-class pocket

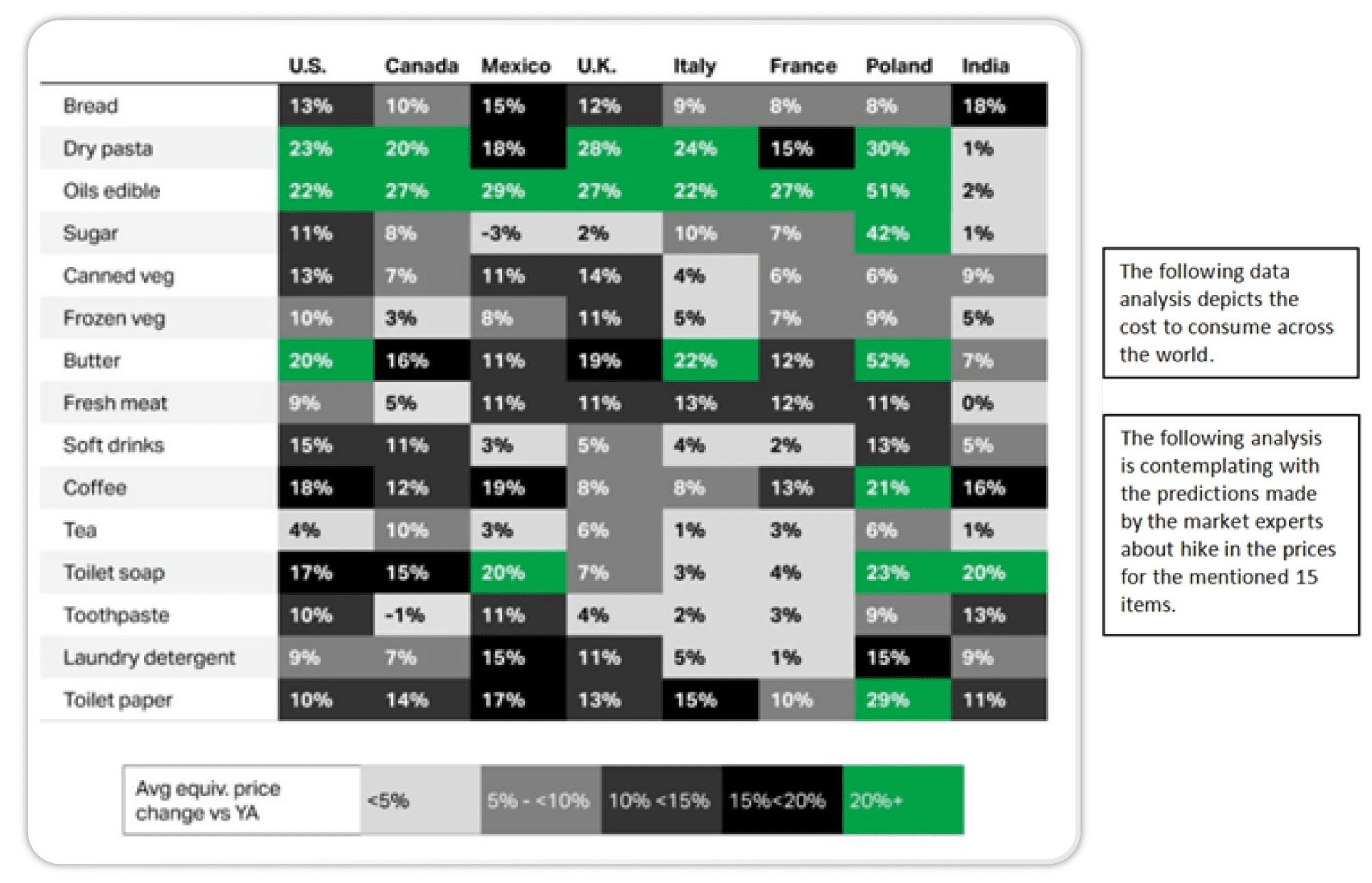

Market experts have coined the year 2023 as ‘the age of thrift’ because it is expected that customers will reshuffle their priorities if they think it is important, and it was the biggest Challenges in CPG Industry. A NielsenIQ report suggests that 63% of the consumers are not happy with the increased cost of living and this has dampened their purchasing power. This has also resulted in making 60% of the consumers more frugal for the same reason.

Read Also: Reality and Future Trends of Indian FMCG amid Covid19: An Interview with Rakesh Kawde

The price of bread in the graph below has increased by 18% which means that for a Rs 10 bread loaf, the consumer will have to shell almost Rs 2 more. For the common man, this increase will most definitely reduce the number of times he buys bread in a week. As his pocket size shrinks, he might even shift to other options such has rice, paratha or millet roti to stretch his budget longer.

4. Intense pressure on profit margins

In March 2017, McKinsey surveyed 600 odd executives all over the world and found out that top growing companies are actively doing three-dimensional effort in three categories:

- Investing: These companies squeeze funds out of various sources (e.g., admin) to double down on existing high-growth activities. Many FMCG companies invest in features like Route optimisation to determine the most efficient beat plans for their sales teams- which maximizes revenue generation (order booking via retailers)

- Creating: Winning companies build value by designing and deploying new products, services, or business models. For e.g. Vrijesh Nagathan, CTO for Marico has adopted a healthy mix of in-house and commercial off-the-shelf digital solutions. It has also planned significant investments for the modernization of its core tech stack and migration to the cloud. “Currently, we are driving a cloud-based data-lake migration along with planning for future data streams. This will provide a boost to the AI/ML initiatives that we are undertaking,”

- Performing: These businesses continuously optimize core commercial capabilities in sales, marketing, pricing, and customer experience. Medimix uses automation to identify dormant, to-be-dormant and dead outlets to create targeted campaigns to revive each category and maximise outlet penetration.

5. Product launches are failing

80% of the product launches in the FMCG industry fail to impress the customers and many of the growth strategies also fall flat. For example, Bisleri Pop, a new range of fizzy drinks, was launched by the biggest bottled water brand in India, Bisleri in 2016. They put in some serious R&D effort to face the Challenges in CPG Industry, allocated a big marketing budget and seemingly did all the right things. Yet, the range failed to take off. The reasons for this debacle were its price, appearance, and rejection by the customers to accept it as a soft drink.

Read Also: Product Launches? BTL activities? Score Big With Deep Market Intelligence

A lot of companies in the FMCG space lack the patience and financial appetite to see innovations through their natural life cycle. Breakthrough innovations take a reasonable time to develop as well as market and most large firms are not allowed that. This means ‘jugaad’ innovations are packaged and marketing as path-breaking, and the products fight a losing battle in the market and many Challenges in CPG Industry. To avoid such failures, it is important to ask the right questions and identify the retail channels where your product is not performing well.

By addressing these issues and taking corrective action, the chances of product success can be increased. The companies can think of removing those items which have very low demand hence critical time can be saved in managing those items. For the critical items the companies can resolve the redundancy and shift their strategy from just-in-time to just-in-case, and the key to this issue is holding extra inventory to engage with multiple suppliers. When a product fails, it offers an opportunity to learn – what went wrong, and what could have been better. And for that authentic, real-time data is key.

6. Rural demand will remain weak amid inflation concerns

The FMCG sector’s revenue growth is expected to be restrained at 7-9% for FY2023 and the following fiscal year due to slow rural demand and high inflation. CRISIL says that volume growth is projected to decline from 2.5% in the last fiscal year to only 1-2% in the current and upcoming fiscal years. Nearly 40% of the industry’s Rs 4.7-lakh-crore revenue is generated from rural markets, which have been adversely impacted by the pandemic, leading to high inflation, low wages, and job losses.

Satish Pillai, MD, India, NielsenIQ says “In continuation from last year, macro-economic indicators are still guiding consumption patterns for the Indian consumer, and they are feeling the impact of the price increase, especially in the food and essentials categories,”.

Challenges in CPG Industry like these aren’t unexpected. What may be unexpected is the nature of these challenges. The only way to pre-empt them is to have data and technology. Manish Bandlish, Managing Director, Mother Dairy Fruit & Vegetable Pvt Ltd, says, “ Digitalization is likely to be a significant driving force in the growth and development of the FMCG sector in 2023,”

No one has any doubts that digitization and automation will continue to remain critical aspects of a brand’s overall strategy, whether it is to generate higher ROI, cast a wider geographical presence, or ensure compliance to newer environment and emission policies. The bigger question is – are you prepared for tomorrow?

About Post Author

Paramdeep Singh

Param is the CEO at FieldAssist. He brings over 12 years of extensive entrepreneurial experience. He is extremely passionate about the FMCG Industry with a focus on technological innovation to drive consumer business outfits, skilfully integrating traditional retail channels with technology solutions that are transforming the face of the Sales Force Automation industry in India. He is well known and recognised for his leveraged collaborative and distinctive leadership skills.