For every founder or a CEO of a startup in FMCG Industry or a relatively young CPG company, there will come a point when s/he will question himself (or herself), “Am I in the right space? Did I make the right decision to launch an FMCG product in an already competitive market?” This doubt is not unfounded, but we’d like to reassure all these FMCG leaders that they are indeed in the right place at the right time. Here’s why.

In 2010, a global KPMG report on mergers and acquisitions in consumer markets called India “a busy market driven by consolidation and economic growth”. Sitting in 2022, we are pretty confident that India is much more than just busy. It is absolutely blazing!

As of date, the mergers, and acquisitions (M&A) activity in India is nearing an all-time high, led by more first-time buyers than ever before, accounting for almost 80 percent of the deals closed in 2020 and 2021—a marked increase from less than 70 percent through 2017 to 2019. While M&A activity has been steady for a few years, the nature of deals in the last two years has been a little different from those of earlier years.

For one, we see a lot more corporate venture capital infusion rather than pure VC funding. While traditional VC firms strive only for above-average financial returns, CVC units also pursue strategic objectives, such as getting ahead of new trends and technologies. In all cases, acquiring a stake in a company or completely acquiring it is a carefully choreographed strategy to enter new verticals, new geographies, or new capabilities

Table of Contents

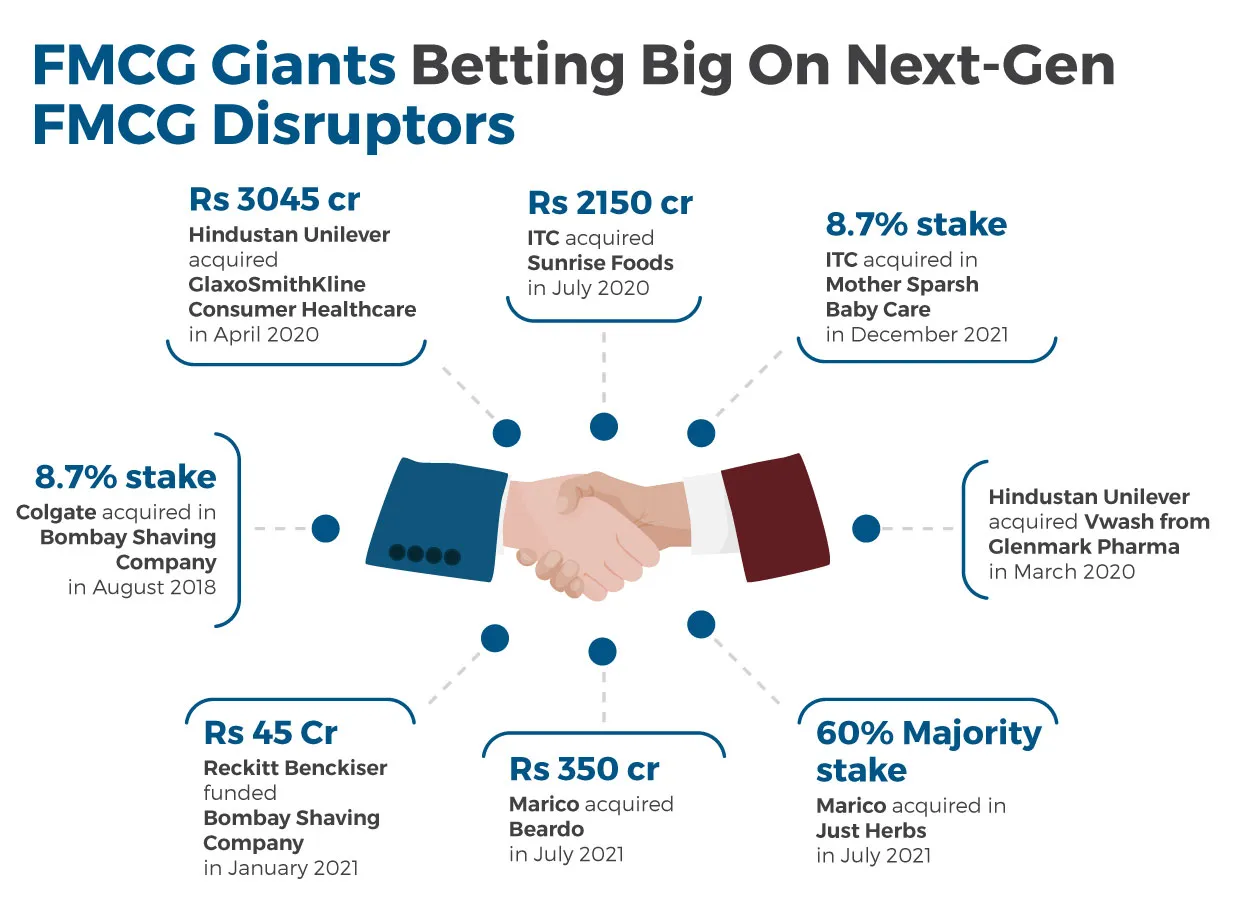

ToggleLet’s look at some of the more recent activities around stakes, mergers & acquisitions in the Indian FMCG industry

- In April 2020, the FMCG industry saw one of its biggest acquisitions, with Hindustan Unilever (HUL) buying out GSK’s Horlicks brand for Rs 3045 crore. Apart from Horlicks, brands such as Boost, Maltova and Viva—part of GlaxoSmithKline Consumer—will also come under HUL’s umbrella.

In June 2020, HUL also completed the acquisition of intimate hygiene brand VWash from Glenmark Pharmaceuticals Ltd, which gave it an entry into the rapidly growing female intimate hygiene segment.

- In July 2020, ITC acquired spices maker Sunrise Foods, which markets spices under a popular brand Sunrise in the eastern parts of the country, for Rs 2,150 crore. The acquisition strengthened the company’s product portfolio and aligned with ITC’s aspiration to expand its footprint across the country.

In Dec 2021, ITC bought an 8.7% equity stake in Mother Sparsh Baby Care – a D2C Ayurvedic and natural personal care brand in FMCG Industry. Mother Sparsh is a premium Ayurvedic and natural personal care start-up of FMCG Industry in the D2C space, focusing on the mother and baby care segment.

- Back in 2018, Colgate Palmolive Asia Pacific made its debut in the Indian consumer brand space by picking up a 14% minority stake in a men’s grooming firm, Bombay Shaving Company. In 2021, another global FMCG major, Reckitt Benckiser (RB) led a ₹45 crore funding round in Visage Lines Personal Care Pvt. Ltd, which owns the grooming brand Bombay Shaving Co.

- In July 2020, men’s grooming start-up Beardo was acquired by Marico, delivering a stellar exit for both the founders and early investors in the company. The company attained profitability in a segment almost non-existent a few years ago.

A year later, in July 2021, Marico also acquired a 60% stake in the ayurvedic beauty brand ‘Just Herbs’, which offers Ayurvedic skin and hair care products made from plant-based ingredients and precious herbs. The investment was in line with Marico’s strategy to accelerate its digital transformation journey by building scalable digital-first brands, either organically or inorganically, as well as to premiums its play in personal care. This investment took Marico one step closer towards their aspiration to build a portfolio of at least 3, Rs 100-crore plus digital brands within the next three years.

- In June 2021, homegrown FMCG Industry company, Emami Ltd picked up a little over 12% additional stake in the male grooming start-up, The Man Company, for an all-cash deal of Rs 50 crore. Emami now owns 45.96 percent in The Man Company, thereby making it the largest shareholder in the 6-year-old male-grooming start-up. Having acquired Zandu and Kesh King in the past, Emami is looking to tap newer opportunities both in India as well as international markets, wherever they see a good strategic fit and the right value.

- In May 2020, Tata Consumer Products Limited acquired PepsiCo’s stake in the Nourish Co JV last year, which is a 50:50 joint venture of Tata Consumer Products Limited and PepsiCo. It operates in the healthy hydration space and has brands like Himalayan mineral water, Tata Gluco Plus and Tata Water Plus. This acquisition gives wings to its ambition in the value-added liquid refreshment beverages space in India. TCPL also acquired Soulful, maker of breakfast cereals and millet-based snacks, which is in line with the company’s strategic intent of entering into new adjacent categories in the food space.

- In October 2021, Nykaa acquired Dot & Key to enter the nutraceutical space. Dot & Key was a D2C brand with a range of skincare solutions. Earlier in 2021, Nykaa Fashion, the fashion e-commerce platform of Nykaa, announced the acquisition of online jewellery brand Pipa Bella. While it has a wide assortment of products under its own in-house beauty brand, Nykaa’s move signals consolidation among smaller, internet-first homegrown brands.

- Two months ago (January 2022), the D2C unicorn, The Good Glamm Group, acquired a majority stake in Organic Harvest, India’s largest ECOCERT-certified beauty and personal care brand. The Good Glamm Group will be investing a further Rs 75 crore in growing the brand. The group, which recently became a unicorn, also made other purchases last year which include Sirona, a fem-tech company that sells feminine hygiene products, St. Botanica and Oriental Botanics, baby-care goods firm The Moms Co, and a tweens’ focused cosmetics brand called POPxo.

- With an IPO that was subscribed over 17 times, Adani Wilmar, known for edible oil ‘Fortune’, is looking to acquire small regional companies or firms that are into ready-to-cook, ready to eat or organic food segments. The company has set aside ₹450 crores for any future acquisitions from the ₹3,600 crore IPO proceeds.

Why the sudden flurry of M&A activity?

Consumers control the market

Today consumers are more aware and more educated about what they want and do not want to consume. This shift in demand has created a growing league of new-age, niche brands that are catering to these specific consumer needs. Now, if the consumer wants something, he gets a whole plethora of options to choose from. And where there are new brands, there will always be investor interest.

Renewed interest from investors

Aggressive private equity purchase is a big factor in ensuring continued interest in the industry. Private VC investment as well corporate VC funding from growth-oriented FMCGs will most likely continue its reign for the better part of this year.

Industry headwinds

According to CRISIL Ratings, the FMCG industry in India is expected to increase at a CAGR of 14.9% to reach US$ 220 billion by 2025, from US$ 110 billion in 2020, while the revenue growth is expected to double from 5-6% in FY21 to 10-12% in FY22. That’s not surprising, considering the FMCG market growth hit a 9-year high in 2021.

Overall, growth has been supported by volume-led expansion due to increased consumption and value-led expansion due to higher product prices, particularly for staples. Another driver has been growth in rural consumption on the back of a good monsoon, improved harvest, and no rollback of MSPs which has increased 2X more than urban consumption.

Relaxation of Rules and low entry barriers

With the new government regulation regarding investments in FMCG companies and accepting foreign-directed investments, the sector has seen a sudden influx of funds. The government has also recently initiated a Self Employment and Talent Utilisation (SETU) scheme where it has invested nearly US$ 163.73 million to boost young entrepreneurs.

FMCG companies invest in other FMCG companies

As demand from new-age consumers inspires more and more new-age brands to emerge, FMCG companies, by investing in other FMCG companies, are elevating the entire CPG industry, opening up new horizons for young brands to grow and explore.

So if you ever had doubts about whether it was a good decision to be in FMCG industry, say goodbye to them at this very moment. Because we assure you, it was the best decision ever. Look at the buzz that’s getting created in the industry, look at the number of FMCG entrepreneurs who showcased their idea in Shark Tank India. Look at the number of made-in-India brands leaping across shores to build an international presence. Look at the millions of rural citizens who aspire to consume the same brands as their urban counterparts.

The way the consumer products space is rapidly growing, the year 2022 is on its way to becoming the year of fresh growth, new marketing approaches, and stronger relationships with customers, distribution partners and investors. New brands will mushroom, catering to the specific needs of a small set of customers. The niches that large brands ignore will become economically viable for these new brands. Rural consumption will light the expansion strategies and Kirana retail will continue to rule the roost as the godfather of the FMCG industry.

Read More: Why Rural Sales Is The Gold Dust That Mesmerizes The CPG Industry?

If there was ever a time to be a part of the FMCG industry that fuels the neural network of the consumer economy, it is today.

About Post Author

Rashmi Kapse

Rashmi is a Content Specialist at FieldAssist. After spending 11 years in the Executive Search business she decided to change tracks and follow her passion for writing. For the past 8 years, she has been writing on Sales Tech, HR Tech, FMCG, Consumer Goods, F&B and Health & Wellness.